Every year, millions of Medicare beneficiaries miss out on hundreds - sometimes over a thousand - dollars in savings simply because they don’t review their prescription drug coverage. If you take even one medication regularly, skipping annual plan changes can cost you. The window to fix this is narrow: Medicare’s Annual Open Enrollment Period runs from October 15 to December 7 each year. Changes made during this time take effect on January 1. If you don’t act, you stay in your current plan - even if your drugs got more expensive, your pharmacy was dropped, or your coverage tier changed.

Why This Matters More Than Ever in 2026

In 2025, the Inflation Reduction Act fully closed the Medicare Part D coverage gap - also known as the “donut hole.” That sounds like good news, and it is. But it’s not the whole story. Plans still adjust premiums, formularies, pharmacy networks, and cost-sharing rules every single year. In fact, 60% of Part D plans change at least one medication’s coverage tier annually, according to CMS. That means a drug you paid $15 for last year might now cost $45. Or worse - it might not be covered at all.

And it’s not just about price. In 2026, new rules kick in: all Medicare Advantage plans must cover Part B drugs administered in outpatient settings - like injections or infusions - without extra charges. That’s great if you’re on insulin, GLP-1 drugs like Ozempic, or cancer therapies. But it also means plan designs are shifting. Some plans might bundle these into higher-tier cost structures. You need to know how it affects your specific meds.

Your Medication List Is Your Starting Point

Before you open the Medicare Plan Finder tool, before you read any brochures, before you call anyone - write down every medication you take. Not just the name. Include:

- Generic and brand name

- Dosage (e.g., 10 mg, 25 mg)

- Frequency (once daily, twice weekly, etc.)

- Pharmacy you currently use

Don’t guess. Check your pill bottles. Pull up your pharmacy app. Ask your pharmacist for a printed list. If you take 5 or more medications - and most Medicare beneficiaries do - this step alone can save you hundreds. A 2024 study by the Medicare Rights Center found that beneficiaries who entered their exact drug list into the Plan Finder tool saved an average of $532 a year just by switching to a plan with better coverage.

Get Your Annual Notice of Change (ANOC)

Between October 1 and October 10, you should receive your Annual Notice of Change (ANOC) in the mail. If you don’t, call your plan or log into your account online. This document tells you exactly what’s changing for next year:

- Monthly premium increase or decrease

- Changes to your drug’s formulary tier (e.g., Tier 2 → Tier 4)

- Pharmacy network changes (your CVS or Walgreens may no longer be preferred)

- New prior authorization or step therapy requirements

For example, if your blood pressure med was on Tier 2 last year (low cost) and is now on Tier 4 (high cost), you’re looking at a 30-50% jump in out-of-pocket expense. The ANOC will say this clearly. Don’t skip reading it. 87% of people who successfully saved money during AEP said they started by reviewing their ANOC first.

Use the Medicare Plan Finder Tool - But Do It Right

Go to Medicare.gov/plan-compare. Enter your ZIP code, your medications, and your preferred pharmacy. The tool will show you all available Part D and Medicare Advantage plans in your area. But here’s the trick: don’t just look at the monthly premium.

Instead, use the “Total Cost Estimate” feature. It calculates your expected annual cost based on:

- Monthly premium

- Deductible

- Cost-sharing per drug tier

- Pharmacy network discounts

- Out-of-pocket maximum

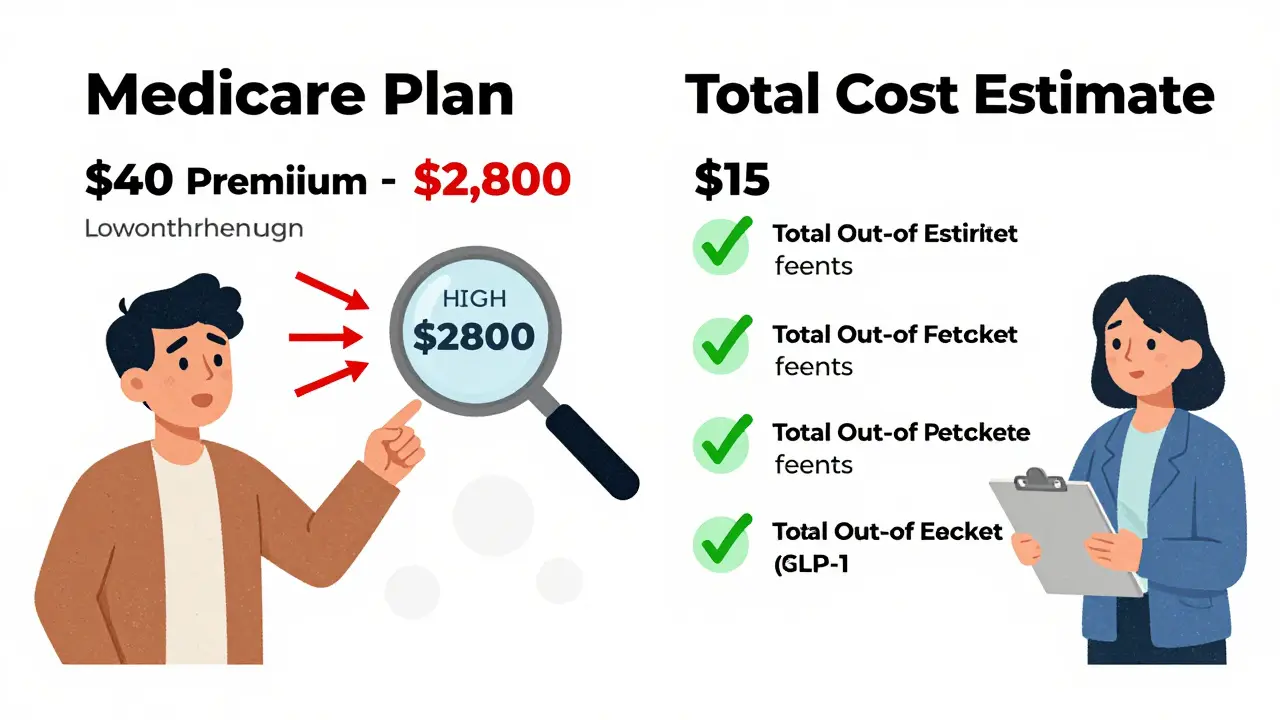

For 2025, the Part D deductible cap is $590. The out-of-pocket maximum for Medicare Advantage plans is $8,000. If you take expensive drugs - like those for diabetes, rheumatoid arthritis, or multiple sclerosis - these numbers matter more than the premium. One beneficiary in Ohio switched from a $40/month plan to a $15/month plan, thinking she saved. But her insulin moved to Tier 4. Her annual cost jumped from $1,200 to $2,800. The cheaper premium wasn’t cheaper at all.

Check Your Pharmacy Network

Many people don’t realize their plan’s pharmacy network can change overnight. In 2024, 78% of Medicare Advantage plans altered their provider networks. If your local pharmacy is no longer “preferred,” you’ll pay full price - not the discounted rate. You might even be forced to mail-order your meds.

Use the Plan Finder tool to enter your exact pharmacy. Then call them. Ask: “Is this pharmacy still in-network for [Plan Name] in 2026?” If they say yes, get it in writing. If they say no, find a nearby preferred pharmacy. Many plans offer discounts at CVS, Walgreens, or Walmart - but only if you fill there. Some plans even have home delivery with $0 copays for maintenance drugs.

Watch Out for Hidden Traps

There are three big mistakes people make every year:

- Assuming your plan is the same - it’s not. Formularies change. Networks change. Costs change.

- Choosing based on premium alone - a $0 premium plan might have a $1,000 deductible and high drug costs.

- Missing the December 7 deadline - if you wait until December 8, you’re stuck until next year. No exceptions.

Also, if you have both Medicare and Medicaid (dual-eligible), be extra careful. Some Medicare Advantage plans offer extra benefits like dental or transportation - but only if you meet income limits. If you lose Medicaid eligibility next year, you might lose those benefits too. Always check the fine print.

When to Call for Help

You don’t have to do this alone. Every state has a State Health Insurance Assistance Program (SHIP). These are free, certified counselors who help Medicare beneficiaries navigate enrollment. They’ve seen every trick, every fine print clause, every plan change. In 2024, 68% of callers to the Medicare Rights Helpline needed help understanding formulary changes - especially for insulin, GLP-1 drugs, and specialty medications.

Call 1-800-MEDICARE or visit shiptacenter.org to find your local SHIP office. Most offer phone, video, or in-person help. You can even schedule an appointment in advance.

Final Checklist: What to Do Before December 7

Here’s your simple 5-step action plan:

- October 1-10: List all your medications with dosages.

- October 10-15: Get and read your ANOC.

- October 15-25: Use Medicare Plan Finder to compare total costs for your drugs.

- October 25-30: Confirm your pharmacy is still in-network.

- December 7: Enroll in your new plan. Set a calendar reminder.

It takes about 3.7 hours total - less than a movie. But the savings can be $1,000+ a year.

What Happens If You Do Nothing?

If you don’t change plans during AEP, you’ll automatically renew your current coverage. That sounds safe. But if your plan increased its drug costs, dropped your pharmacy, or moved your insulin to a higher tier - you’re stuck paying more. And you can’t switch again until next October.

There’s one exception: the Medicare Advantage Open Enrollment Period (MAOEP) from January 1 to March 31. But that only lets you switch from one Medicare Advantage plan to another - or back to Original Medicare. You can’t change your Part D plan during MAOEP. So if your drug coverage is bad, you’re out of luck until next year.

Can I switch Medicare Part D plans outside of Open Enrollment?

Generally, no. The only time you can switch Part D plans is during the Annual Open Enrollment Period (October 15-December 7). Exceptions exist only if you qualify for a Special Enrollment Period - such as moving out of your plan’s service area, losing employer coverage, or becoming eligible for Medicaid. Otherwise, you must wait until next year.

What if my medication isn’t covered at all next year?

If your current drug is removed from a plan’s formulary, you can request a formulary exception. Your doctor can submit a letter explaining why you need it - for example, if alternatives caused side effects or didn’t work. If approved, the plan must cover it. But this process takes time. It’s better to switch to a new plan that covers your drug before the year starts.

Are all Medicare Advantage plans required to include drug coverage?

Yes, nearly all of them do. As of 2025, 90% of Medicare Advantage plans include Part D prescription drug coverage. If a plan doesn’t include drugs, you can’t enroll in it unless you already have another Part D plan. Always check the plan details before signing up.

How much can I save by switching plans?

The average beneficiary who compares plans saves $532 per year on prescription costs alone, according to Justice in Aging’s 2025 analysis. Some save over $1,200 - especially if they’re on high-cost drugs like insulin, Ozempic, or specialty injectables. One woman in Florida saved $1,800 by switching from a plan that charged $75 per month for her diabetes med to one that covered it at $15.

Do I need to enroll in a Part D plan if I have Medicare Advantage?

No - if your Medicare Advantage plan includes drug coverage (which most do), you don’t need a separate Part D plan. In fact, having both can cause confusion and overpayment. If your Advantage plan doesn’t include drugs, then you must enroll in a standalone Part D plan to avoid late enrollment penalties.

Rachidi Toupé GAGNON

Just did my annual meds review and saved $800 this year 😎

Turns out my insulin moved to Tier 1 on a $12/month plan. Who knew?!

Do the damn work. It’s not a chore-it’s a free money hack.

Also, Walmart. Always Walmart. 🏷️

Neha Motiwala

EVERY SINGLE YEAR THEY CHANGE THE RULES-IT’S A SCAM.

THEY WANT YOU TO BE CONFUSED SO YOU STAY ON THE EXPENSIVE PLAN.

I SAW A FORMULARY CHANGE NOTICE THAT LITERALLY SAID 'WE REMOVED YOUR DRUG BECAUSE YOU’RE TOO OLD TO NEED IT.'

THEY’RE NOT HELPING YOU-THEY’RE PROFITING FROM YOUR CONFUSION.

CALL THE GOVERNMENT. CALL YOUR REPRESENTATIVE. CALL YOUR NEIGHBOR. THIS IS A CRISIS.

WHY ISN’T THIS ON THE NEWS?

THEY’RE LYING TO YOU.

Craig Staszak

Man I used to skip this every year until I got hit with a $300 surprise on my blood pressure med

Now I treat it like tax season-set a reminder, grab my pill bottles, and go to town on Medicare.gov

Best part? I found a plan that covers my wife’s arthritis drug too

10 minutes of work saved us over $1k

Do it. Seriously.

Alyssa Williams

OMG I just switched and my Ozempic went from $110 to $15 a month

I almost cried

Also my pharmacy changed from CVS to Walgreens-so I had to drive 3 miles

WORTH IT

YOU GUYS NEED TO DO THIS

IT’S NOT HARD

JUST LIST YOUR MEDS

AND CLICK

Ernie Simsek

Let’s break this down like a financial model

Annual premium: $15

Deductible: $590

Insulin Tier 4: $80 copay x 12 = $960

Pharmacy network: out-of-network = +$200

Out-of-pocket max: $8k - irrelevant if you’re on 3 specialty drugs

Bottom line: the cheapest premium is the most expensive plan

Use the Total Cost Estimate. Every. Single. Time.

Also-Walmart’s $4 generics are still king

Sonja Stoces

What if your plan changes your drug to a different generic that doesn’t work?

What if your doctor’s note gets ignored?

What if the formulary exception takes 6 weeks and you run out?

What if the new plan says 'covered' but your pharmacy says 'not in network'?

This system is rigged.

I’ve been in this for 7 years.

You think you’re saving money?

You’re just playing Russian roulette with your health.

Robert Petersen

Just wanna say-you’re not alone.

I was scared to touch this stuff too.

Called my SHIP counselor-she walked me through it in 20 mins.

Turns out my plan dropped my pharmacy last year and I didn’t even notice.

Now I’m on a $9/month plan with home delivery.

It’s not magic.

It’s just knowing where to look.

You got this.

alex clo

It is imperative that beneficiaries engage in proactive plan evaluation during the Annual Enrollment Period.

Failure to do so may result in significant financial liability due to formulary and network discontinuities.

Recommendation: Utilize the Medicare Plan Finder Tool with precision and verify all data points with official documentation.

Consultation with a certified counselor is strongly advised for individuals with complex medication regimens.

Joanne Tan

my mom is 79 and i did this for her

she was on a plan that charged $90 for her heart med

we switched to a $12 one that delivers to her house

she cried

she said 'i thought i was stuck'

you’re not stuck

just take 10 mins

it changes everything

Reggie McIntyre

So I found this wild thing-some plans actually pay you to use certain pharmacies?

Like, you fill your meds at Walmart and they give you a $25 gift card?

And some have $0 copays on maintenance drugs if you do mail-order?

I didn’t even know that was a thing

Why isn’t this advertised?

Why do we have to dig for it like treasure?

Also-did you know some plans cover insulin at $35/month no matter what?

It’s not a myth. It’s real.

Go look.